Assets depreciation generate automatically from Vendor bills

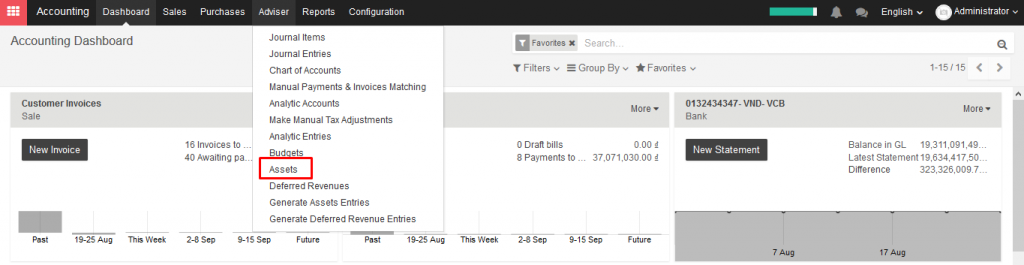

To depreciate an asset, open Accounting module ‣ Accounting ‣ Assets

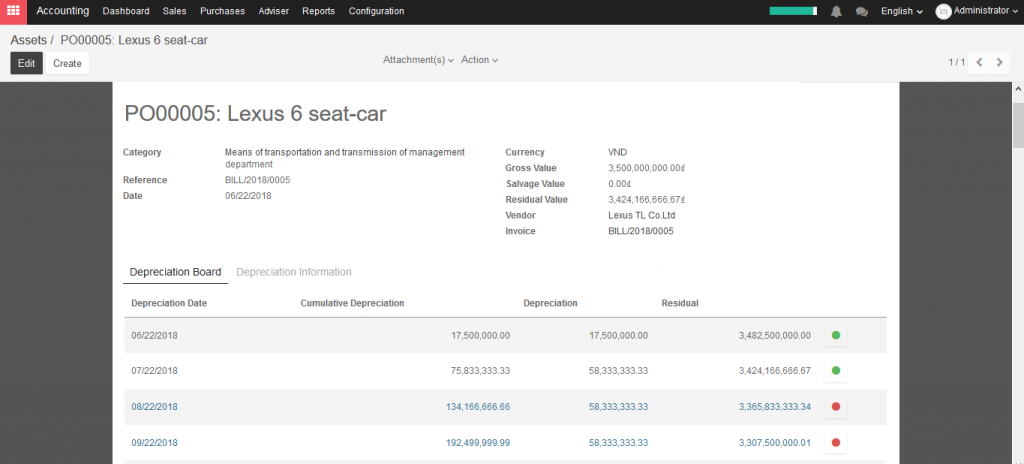

KIU will create depreciation journal entries automatically at the right date for every confirmed asset. (not the draft ones). You can control the depreciation board: a green bullet point means that the journal entry has been created for this line.

But you can also post journal entries before the expected date by clicking on the green bullet and forcing the creation of a related depreciation entry.

In the Depreciation board, click on the red bullet to post the journal entry. Click on the Items button on the top to see the journal entries which are already posted.

→ Create assets depreciation manually

To register an asset manually, go to the menu Adviser ‣ Assets.

Once your asset is created, don’t forget to Confirm it. You can also click on the Compute Depreciation button to check the depreciation board before confirming the asset.

Note: If you create assets manually, you still need to create the supplier bill for this asset. The asset document will only produce the depreciation journal entries, not those related to the supplier bill.