Deferred/unearned revenue is an advance payment recorded on the recipient’s balance sheet as a liability account until either the services have been rendered or the products have been delivered. Deferred revenue is a liability account because it refers to revenue that has not yet been earned, but represents products or services that are owed to the customer. As the products or services are delivered over time, the revenue is recognized and posted on the income statement.

For example: let’s say you sell a 2 year support contract for VND24,000,000 that begins next month for a period of 24 months. Once you validate the customer invoice, the VND24,000,000 should be posted into a deferred revenues account. This is because the VND24,000,000 you received has not yet been earned.

Over the next 24 months, you will be reducing the deferred revenues account by VND1,000,000 (VND24,000,000/24) on a monthly basis and recognizing that amount as revenue.

→ Configuration

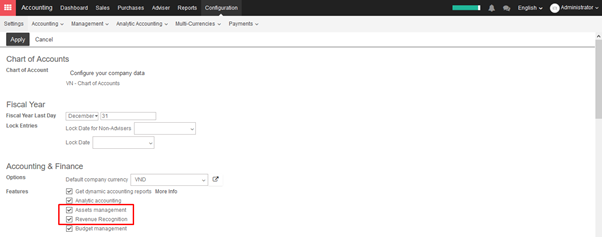

In order to automate deferred revenues, go to the settings menu under the module Accounting ‣ Configuration and activate the Assets management & revenue recognition option. This will install the Revenue Recognition Management module.