- Overview

Landed costs include all charges associated to a good transfer.

Landed cost includes = Cost of product + Shipping + Customs + Risk

All of these components might not be applicable in every shipment, but relevant components must be considered as a part of the landed cost. We have to identify landed cost to decide sale price of product because it will impact on company profits.

- Configuration

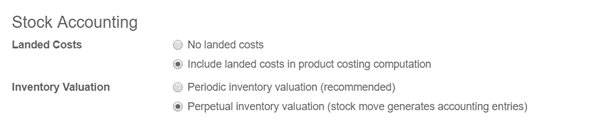

- Go to Inventory ‣ Configuration ‣ Setting. Check accounting option Include landed costs in product costing computation & Perpetual inventory valuation, then click on Apply to save changes.

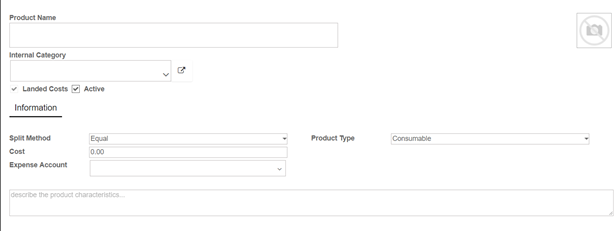

Landed Cost Types: Start by creating specific products to indicate your various Landed Costs, such as freight, insurance or customs duties. Go to Inventory ‣ Configuration ‣ Landed Cost types.

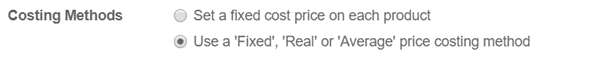

- Then go to the Purchase ‣ Configuration ‣ Setting. Choose costing method Use a ‘Fixed’, ‘Real’ or ‘Average’ price costing method, then click on Apply to save changes.

Note: Landed costs are only possible for product configured in real time valuation with real price costing method. The costing method is configured on the product category

- Link landed costs to a transfer

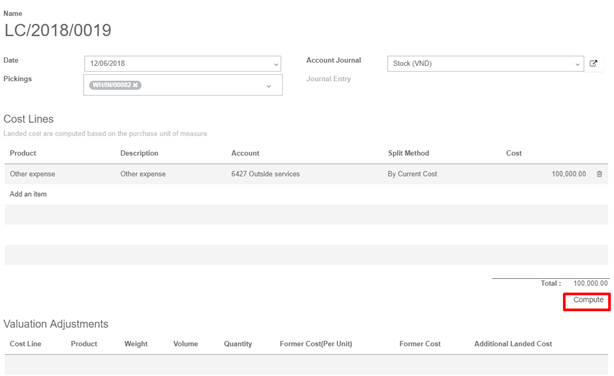

To calculate landed costs, go to Inventory ‣ Inventory Control ‣ Landed Costs.

Click on the Create button and select the picking you want to attribute landed costs. Select the account journal in which to post the landed costs. We recommend you to create a specific journal for landed costs. Therefore it will be easier to keep track of your postings.

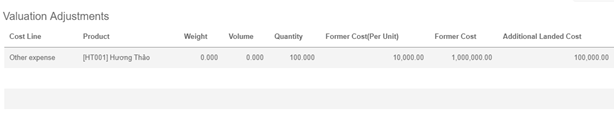

Click the Compute button to see how the landed cost will be split across the picking lines. To confirm the landed cost attribution, click on the Validate button