→ How to record a new vendor bill

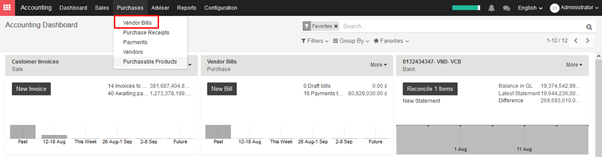

When a vendor bill is received, you can record it from Purchases ‣ Vendor Bills in the Accounting module. As a shortcut, you can also use the New Bill feature on the accounting dashboard.

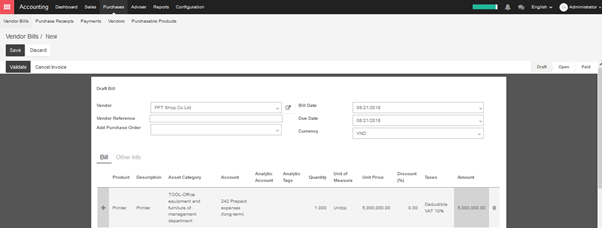

To register a new vendor bill, start by selecting a vendor and inputting their invoice as the Vendor Reference, then add and confirm the product lines, making sure to have the right product quantities, taxes and prices.

Save the invoice to update the pre tax and tax amounts at the bottom of the screen. You will most likely need to configure the prices of your products without taxes as KIU will compute the tax for you.

→ How to validate The Vendor Bill

Once the vendor bill is validated, a journal entry will be generated based on the configuration on the invoice. This journal entry may differ depending on the accounting package you choose to use.

For most European countries, the journal entry will use the following accounts:

- Accounts Payable: defined on the vendor form

- Taxes: defined on the products and per line

- Expenses: defined on the line item product used

For Anglo-Saxon (US) accounting, the journal entry will use the following accounts:

- Accounts Payable: defined on the vendor form

- Taxes: defined on the products and per line

- Goods Received: defined on the product form

You can check your Profit & Loss or the Balance Sheet reports after having validated a couple of vendor bills to see the impact on your general ledger.