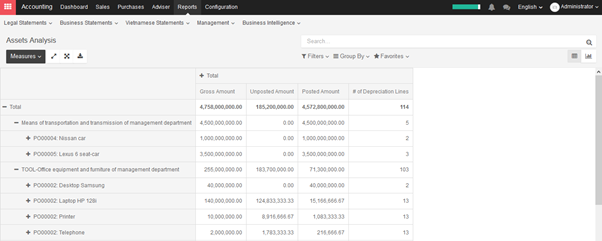

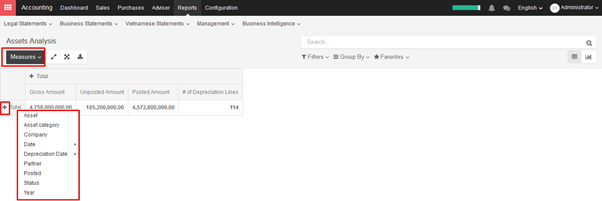

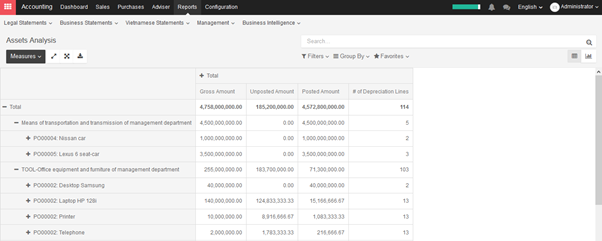

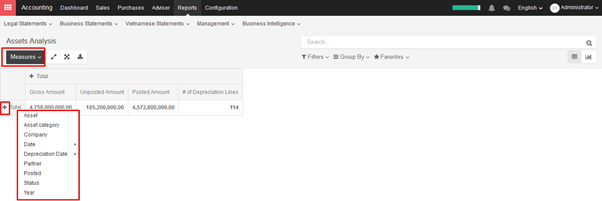

KIU will summarize and create a report to manage your company assets in Reports ‣ Assets. You can filter and customize report as your preference.

KIU will summarize and create a report to manage your company assets in Reports ‣ Assets. You can filter and customize report as your preference.

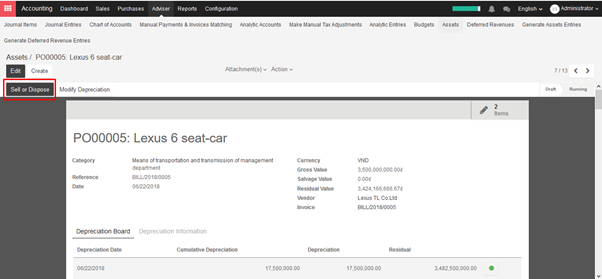

If you sell or dispose an asset, you need to depreciate completely this asset. Click on the button Sell or Dispose in depreciation form.

The system will generate entry automatically. This action will post the full costs of this assets but it will not record the sales transaction that should be registered through a customer invoice.

→ Assets depreciation generate automatically from Vendor bills

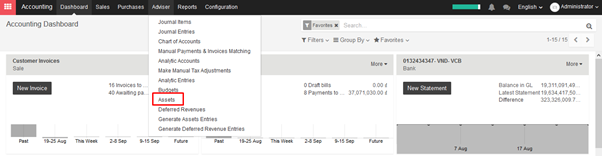

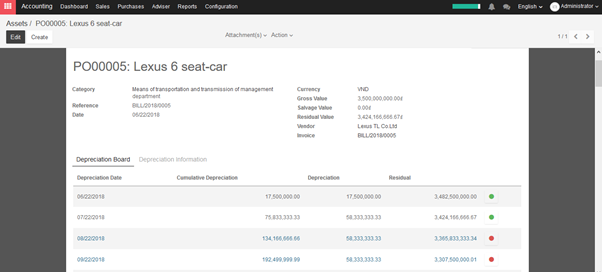

To depreciate an asset, open Accounting module ‣ Adviser ‣ Assets

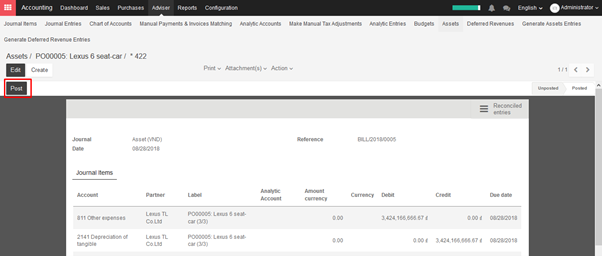

KIU will create depreciation journal entries automatically at the right date for every confirmed asset. (not the draft ones). You can control in the depreciation board: a green bullet point means that the journal entry has been created for this line.

But you can also post journal entries before the expected date by clicking on the green bullet and forcing the creation of related depreciation entry.

In the Depreciation board, click on the red bullet to post the journal entry. Click on the Items button on the top to see the journal entries which are already posted.

→ Create assets depreciation manually

To register an asset manually, go to the menu Adviser ‣ Assets.

Once your asset is created, don’t forget to Confirm it. You can also click on the Compute Depreciation button to check the depreciation board before confirming the asset.

Note:

If you create asset manually, you still need to create the supplier bill for this asset. The asset document will only produce the depreciation journal entries, not those related to the supplier bill.

Explanation of the fields:

Status

When an asset is created, the status is ‘Draft’.

If the asset is confirmed, the status goes in ‘Running’ and the depreciation lines can be posted in the accounting.

You can manually close an asset when the depreciation is over. If the last line of depreciation is posted, the asset automatically goes in that status.

Category

Category of asset

Date

Date of asset

Gross Value

Gross value of asset

Salvage Value

It is the amount you plan to have that you cannot depreciate.

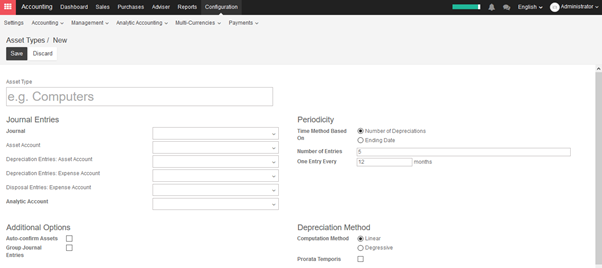

Computation Method

Choose the method to use to compute the amount of depreciation lines.

* Linear: Calculated on basis of: Gross Value / Number of Depreciations

* Degressive: Calculated on basis of: Residual Value * Degressive Factor

Time Method

Choose the method to use to compute the dates and number of depreciation lines.

* Number of Depreciations: Fix the number of depreciation lines and the time between 2 depreciations.

* Ending Date: Choose the time between 2 depreciations and the date the depreciations won’t go beyond.

Prorata Temporis

Indicates that the first depreciation entry for this asset have to be done from the purchase date instead of the first January / Start date of fiscal year

Number of Depreciations

The number of depreciations needed to depreciate your asset

Number of Months in a Period

The amount of time between two depreciations, in months

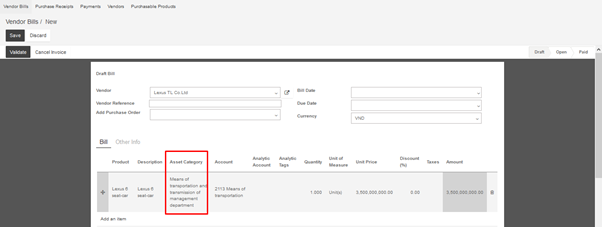

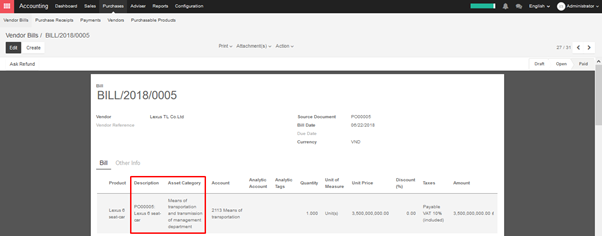

Assets can be automatically created from supplier bills. All you need to do is to set an asset category on your bill line. When the user will validate the bill, an asset will be automatically created, using the information of the supplier bill.

Depending on the information on the asset category, the asset will be created in draft or directly validated. It’s easier to confirm assets directly so that you won’t forget to confirm it afterwards. (Check the field Skip Draft State on Asset Category) Generate assets in draft only when you want your adviser to control all the assets before posting them to your accounts.

Besides, you can also do buy this asset through purchase order, then create Vendor bills.

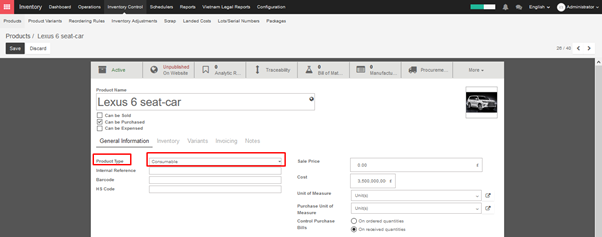

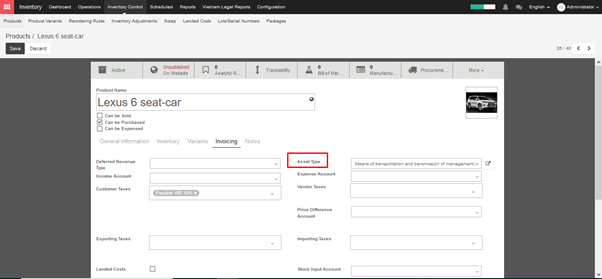

An asset will be created in product form as another product.

Open Sales/Purchase/Inventory module ‣ Products ‣ Create

To determine a product as an asset, you have to choose asset category for this product and it will automatically be filled in the supplier bill.

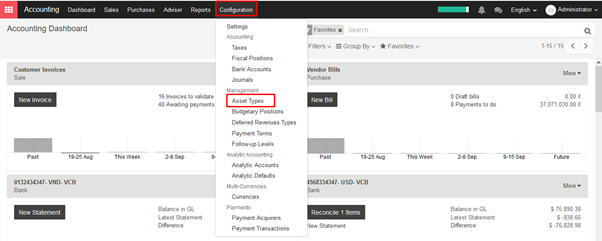

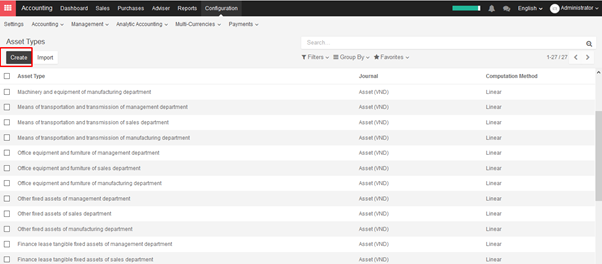

To define asset types, go to Configuration ‣ Asset Types ‣ Create

Every year your inventory valuation has to be recorded in your balance sheet. This implies two main choices:

→ Costing Method

KIU allows any method. The default one is Standard Price. To change it, check Use a ‘Fixed’, ‘Real’ or ‘Average’ price costing method in Purchase settings. Then set the costing method from products’ internal categories. Categories show up in the Inventory tab of the product form.

Whatever the method is, KIU provides a full inventory valuation in Inventory ‣ Reports ‣ Inventory Valuation (i.e. current quantity in stock * cost price).

→ Periodic Inventory Valuation

In a periodic inventory valuation, goods reception and outgoing shipments have no direct impact in the accounting. At the end of the month or year, the accountant posts one journal entry representing the value of the physical inventory.

At the end of the month/year, your company does a physical inventory or just relies on the inventory in KIU to value the stock into your books.

Then you need to break down the purchase balance into both the inventory and the cost of goods sold using the following formula:

Cost of goods sold (COGS) = Starting inventory value + Purchases – Closing inventory value.

→ Perpetual Inventory Valuation

In a perpetual inventory valuation, goods receptions and outgoing shipments are posted in your books in real time. The books are therefore always up-to-date. This mode is dedicated to expert accountants and advanced users only. As opposed to periodic valuation, it requires some extra configuration & testing.

Every year your inventory valuation has to be recorded in your balance sheet. This implies two main choices:

→ Costing Method

KIU allows any method. The default one is Standard Price. To change it, check Use a ‘Fixed’, ‘Real’ or ‘Average’ price costing method in Purchase settings. Then set the costing method from products’ internal categories. Categories show up in the Inventory tab of the product form.

Whatever the method is, KIU provides a full inventory valuation in Inventory ‣ Reports ‣ Inventory Valuation (i.e. current quantity in stock * cost price).

→ Periodic Inventory Valuation

In a periodic inventory valuation, goods reception and outgoing shipments have no direct impact in the accounting. At the end of the month or year, the accountant posts one journal entry representing the value of the physical inventory.

At the end of the month/year, your company does a physical inventory or just relies on the inventory in KIU to value the stock into your books.

Create a journal entry to move the stock variation value from your Profit & Loss section to your assets.

→ Perpetual Inventory Valuation

In a perpetual inventory valuation, goods receptions and outgoing shipments are posted in your books in real time. The books are therefore always up-to-date. This mode is dedicated to expert accountants and advanced users only. As opposed to periodic valuation, it requires some extra configuration & testing.

As stated in the *inventory valuation page*, one of the possible costing method you can use in perpetual stock valuation, is the average cost.

This document answers to one recurrent question for companies using that method to make their stock valuation: how does a shipping returned to its supplier impact the average cost and the accounting entries? This document is only for the specific use case of a perpetual valuation (as opposed to the periodic one) and in average price costing method (as opposed to standard of FIFO).

→ Definition of average cost

The average cost method calculates the cost of ending inventory and cost of goods sold on the basis of weighted average cost per unit of inventory.

The weighted average cost per unit is calculated using the following formula:

→ Defining the purchase price

The purchase price is estimated at the reception of the products (you might not have received the vendor bill yet) and reevaluated at the reception of the vendor bill. The purchase price includes the cost you pay for the products, but it may also includes additional costs, like landed costs.

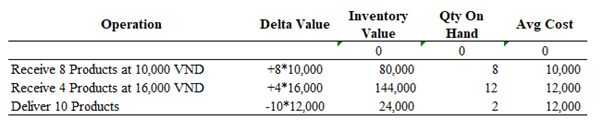

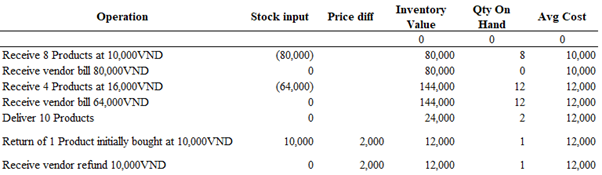

At the beginning, the Avg Cost is set to 0 set as there is no product in the inventory. When the first reception is made, the average cost becomes logically the purchase price.

At the second reception, the average cost is updated because the total inventory value is now 80,000 + 4*16,000 = 144,000VND. As we have 12 units on hand, the average price per unit is 144,000 / 12 = 12,000VND.

By definition, the delivery of 10 products does not change the average cost. Indeed, the inventory value is now 24,000 VND as we have only 2 units remaining of each 24,000 / 2 = 12,000 VND.

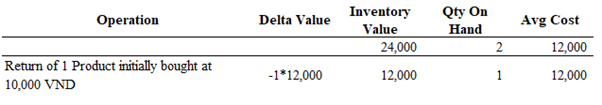

In case of a product returned to its supplier after reception, the inventory value is reduced using the average cost formulae (not at the initial price of these products!).

Which means that the above table will be updated as follow:

Remember the definition of Average Cost, saying that we do not update the average cost of a product leaving the inventory. If you break this rule, you may lead to inconsistencies in your inventory.

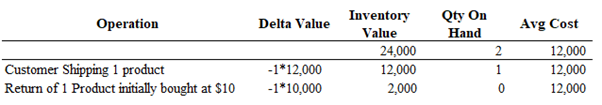

As an example, here is the scenario when you deliver one piece to the customer and return the other one to your supplier (at the cost you purchased it). Here is the operation:

As you can see in this example, this is not correct: an inventory valuation of 2,000 VND for 0 pieces in the warehouse.

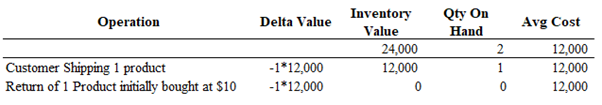

The correct scenario should be to return the goods at the current average cost:

On the other hand, using the average cost to value the return ensure a correct inventory value at all times.

For people in using the anglo saxon accounting principles, there is another concept to take into account: the stock input account of the product, which is intended to hold at any time the value of vendor bills to receive. So the stock input account will increase on reception of incoming shipments and will decrease when receiving the related vendor bills.

Back to our example, we see that when the return is valued at the average price, the amount booked in the stock input account is the original purchase price:

This is because the vendor refund will be made using the original purchase price, so to zero out the effect of the return in the stock input in last operation, we need to reuse the original price. The price difference account located on the product category is used to book the difference between the average cost and the original purchase price.

A company might have several bank accounts or cash registers. Within KIU it is possible to handle internal transfers of money with only a couple of clicks.

We will take the following example to illustrate. My company has two bank accounts and I want to transfer 10,000,000 VND from one of our bank accounts to the another one.

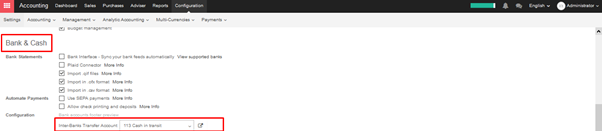

→ Check your Chart of Accounts and default transfer account

To handle internal transfers you need a transfer account in your charts of account. KIU will generate an account automatically based on the country of your chart of account. To parameter your chart of account and check the default transfer account go into your the accounting module, select Configuration ‣ Settings.

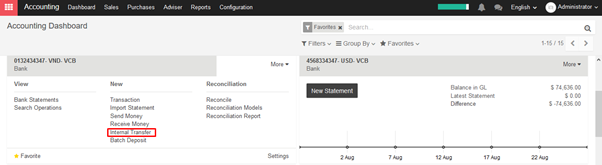

→ Log an internal transfer

The first step is to register the internal paiement. To do so, go into your accounting dashboard. click on the more button of one of your banks and select New ‣ Internal transfer.

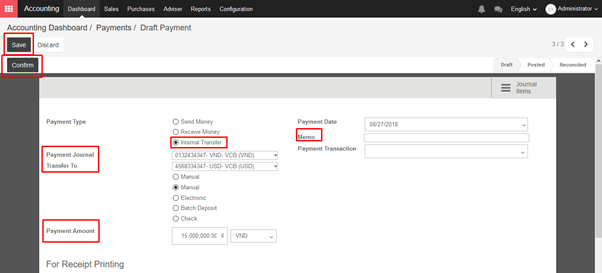

Create a new payment. The payment type will automatically be set to internal transfer. Select the Bank you want to transfer to, specify the Amount and add a Memo if you wish.

Save and confirm the changes to register the payment.

In terms of accounting the money is now booked in the transfer account. We’ll need to import bank statements to book the money in the final accounts.

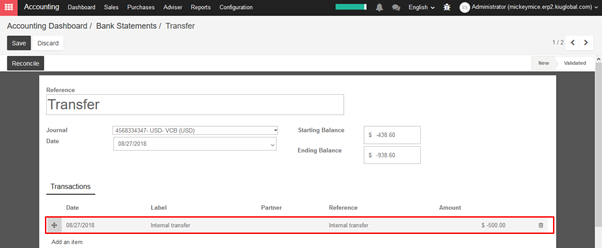

→ Import bank statements and reconcile

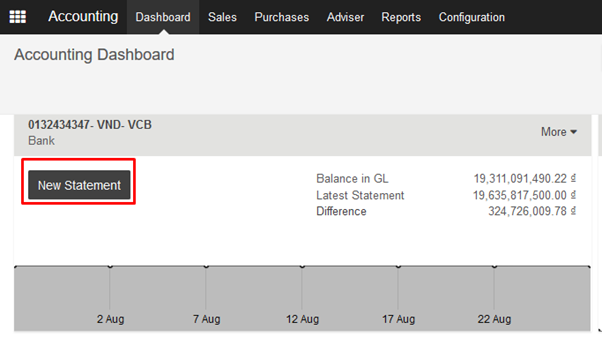

Note that the bank balance computed by KIU is different that the last statement of your bank.

That is because we did not import the bank statement confirming the departure and arrival of the money. It’s thus necessary to import your bank statement and reconcile the payment with the correct bank statement line. Once you receive your bank statements click the new statement button of the corresponding bank to import them.

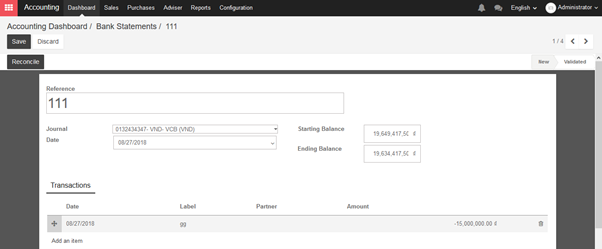

Fill in your Transactions line. Once done, KIU will display a Computed Balance. that computed balance is the theoretical end balance of your bank account. If it’s corresponding to the bank statement, it means that no errors were made. Fill in the Ending balance and click on the Reconcile button.

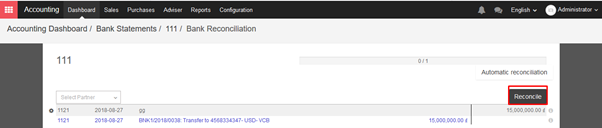

The following window will open:

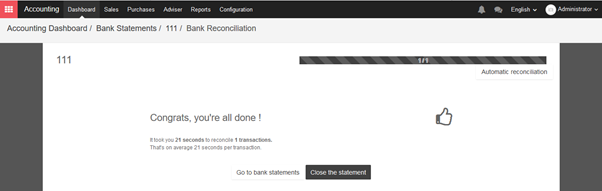

You need to choose counterparts for the paiement. Select the correct bank statement line corresponding to the paiement and click on the reconcile button. Close the statement to finish the transaction

The same steps will need to be repeated once you receive your second bank statement. Note that if you specify the correct amount, and the same memo in both bank statement and payment transaction then the reconciliation will happen automatically.